UK Regulator Says 87% of Crypto Registration Applications Failed to Meet Standards for Approval

The FCA approved only four of the 35 applications it received in the year ended March 31.

The UK's Financial Conduct Authority (FCA) reported that 87% of crypto registration applications failed to meet approval standards in the 2023-2024 fiscal year, approving only four of 35 submissions.

Since assuming oversight of crypto firms under anti-money laundering rules in 2020, the FCA has approved just 44 out of 359 applications. Crypto companies cited long wait times, limited feedback, and perceived unfair treatment as barriers, with some relocating abroad to serve UK customers from other jurisdictions. The FCA is awaiting further legislation to fully authorize crypto companies operating within the UK.

Founder of a crypto ‘Ponzi’ scheme’ IcomTech sentenced to 10 years in prison

David Carmona, the founder of the cryptocurrency Ponzi scheme IcomTech, was sentenced to 10 years in prison for conspiracy to commit wire fraud. Between 2018 and 2019, IcomTech allegedly defrauded investors of $8.4 million by promising financial freedom and high returns from crypto trading and mining, which never materialized. Carmona and other promoters lured victims through extravagant expos and luxury displays, encouraging them to invest based on false claims.

Coinbase to Delist Unauthorized Stablecoins in EU by December

Tether, which is the largest issuer of stablecoins, doesn't have the necessary e-money license yet in the European Union.

Click Here for full Article

Terminology

What is MiCA?

MiCA, or the Markets in CryptoAssets Regulation, is a comprehensive legislative framework proposed by the European Union aimed at regulating the cryptocurrency market. It seeks to establish a uniform set of rules across EU member states to enhance consumer protection, ensure financial stability, and foster innovation in the digital asset space. It mainly covers:

- Authorization: Single license for cryptoasset service providers (CASPs) to operate across the EU.

- Asset Types: Categorizes assets into asset-referenced tokens, e-money tokens, and utility tokens.

- Transparency: Issuers must provide detailed white papers for investor clarity.

- Consumer Protection: Stricter rules to prevent fraud and market manipulation in advertising and marketing.

Coinbase has announced plans to delist unauthorized stablecoins in the European Union by December 30, 2024, to comply with the EU's Markets in Crypto Assets (MiCA) regulations. These rules mandate that stablecoin issuers must obtain an e-money license from an EU member state, a requirement that has been in effect since June 30, 2024. While Circle, the second-largest stablecoin issuer, has successfully secured such a license, Tether—the largest issuer—has yet to obtain one.

As part of its compliance efforts, Coinbase intends to provide European Economic Area (EEA) users with options for stablecoins issued by authorized firms, such as Circle's USDC and EURC. The exchange plans to share additional details about its strategy in November, ensuring that users have access to compliant stablecoin alternatives as the regulatory landscape evolves.

Hackers have started using AI to churn out malware

Hackers have started using generative AI to accelerate malware development, making it easier for tech-savvy individuals to create malicious software. A recent HP Wolf Security report revealed a new variant of the asynchronous remote access trojan (AsyncRAT) discovered during an investigation of a suspicious email masquerading as a French invoice. This version included an injection method likely generated by AI, evident from its well-commented code and structured naming conventions, which are unusual for traditional malware.

This highlights a troubling advancement as it lowers the barrier for cybercriminals and accelerates attack frequency, raising significant concerns in the cybersecurity community.

Is DeFi ready for mass adoption, or will regulation slow it down?

As decentralized finance surges past $100 billion in total value locked, it's clear this revolutionary technology is no longer an experiment.

As decentralized finance (DeFi) surpasses $100 billion in total value locked, it has transitioned from an experimental phase to a significant global movement, garnering attention in Congressional hearings. Companies like Aave and MakerDAO are bridging the gap between DeFi and traditional finance, enhancing accessibility for institutions and everyday users, and reflecting trust through the growing total value locked (TVL) in various protocols.

DeFi is essential for addressing financial disparities, particularly for unbanked populations, allowing access to global markets without intermediaries like banks. Platforms such as Compound and Uniswap are providing decentralized financial services, reducing fees and increasing transparency compared to conventional systems.

However, overregulation could threaten DeFi’s core principles of decentralization and innovation, deterring development and pushing smaller projects out of the market. To foster a balanced regulatory environment, the U.S. should tailor regulations to DeFi's unique characteristics, encouraging innovation while ensuring consumer protection. Involving DeFi stakeholders in the regulatory process and adopting a “light-touch” approach could enhance the financial landscape for a broader audience.

Email auto-reply vulnerability allows hackers to mine cryptocurrency

Hackers exploit email auto-replies to spread crypto-mining malware, hijacking unsuspecting users’ systems to mine cryptocurrency without their knowledge.

Cybersecurity researchers have discovered a novel method used by hackers to deliver malware for stealthy crypto mining, leveraging automated email replies. Researchers from the threat intelligence firm Facct reported that hackers exploited auto-reply emails from compromised accounts to target Russian companies, marketplaces and financial institutions.

UAE exempts crypto transfers, conversion from value-added tax

The UAE has exempted cryptocurrency transfers and conversions from value-added tax, positioning itself as a more crypto-friendly jurisdiction for digital asset transactions.

The UAE has updated its VAT regulations to exempt cryptocurrency transfers and conversions from VAT, applying this change retroactively to January 1, 2018. This exemption also includes services related to investment fund management, allowing virtual asset companies to adjust their tax recovery status and potentially submit voluntary disclosures to comply with the updated tax framework.

This move aligns with the UAE's strategy to create a more favorable environment for crypto transactions and further solidify its position as a hub for digital assets. By clarifying tax obligations, the UAE hopes to attract more crypto businesses and enhance its regulatory landscape for digital assets.

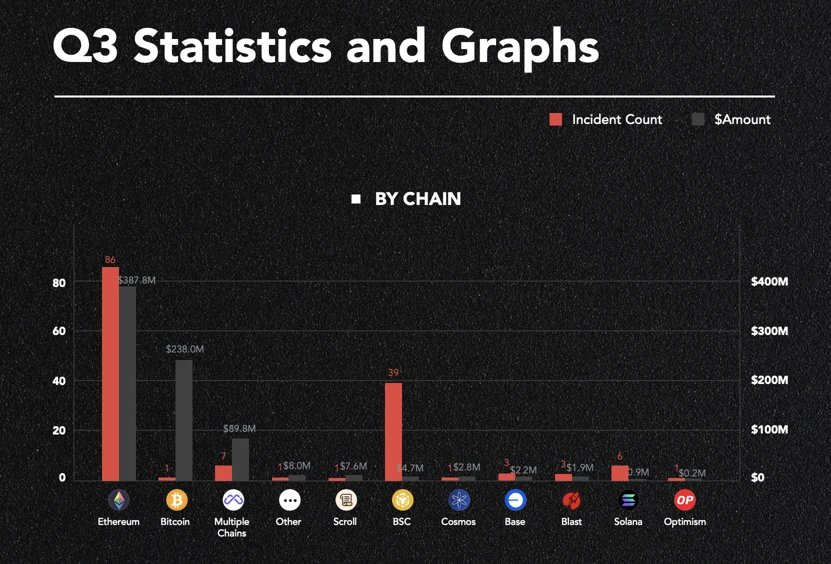

Q3 2024 saw a decline in the number of crypto hacks, but the value of assets stolen spiked, with $753 million lost across 155 incidents.

Crypto hackers steal $750M in Q3 2024, as losses grow by 9.5% — CertiK

In Q3 2024, crypto hackers stole approximately $753 million across 155 incidents, marking a 9.5% increase in financial losses despite fewer attacks overall, as reported by CertiK. The Ethereum network was hardest hit, suffering over $387 million in losses across 86 incidents, while the largest single theft involved a compromised Bitcoin wallet losing $238 million. Phishing was the most prevalent attack type, causing $343 million in losses, followed by private key compromises.

"UAE Exempts Crypto Transfers, Conversions from VAT." Cointelegraph, 2024, https://cointelegraph.com/news/uae-exempts-crypto-transfers-conversions-from-vat.

"Coinbase to Delist Unauthorized Stablecoins in EU by December." CoinDesk, 4 Oct. 2024, https://www.coindesk.com/policy/2024/10/04/coinbase-to-delist-unauthorizedstablecoins-in-eu-by-december/.

"UK Regulator Says 87% of Crypto Registration Applications Failed to Meet Standards for Approval." CoinDesk, 5 Sept. 2024, https://www.coindesk.com/policy/2024/09/05/ukregulator-says-87-of-crypto-registration-applications-failed-to-meet-standards-for-approval/.

"Crypto Hackers Steal $750 Million in Q3 2024, as Losses Grow by 9.5%." Cointelegraph, 2024, https://cointelegraph.com/news/crypto-hackers-steal-750-million-q3-2024-certik.

"Founder of Crypto Ponzi Icomtech Receives 10-Year Prison Sentence." Cointelegraph, 2024, https://cointelegraph.com/news/founder-of-crypto-ponzi-icomtech-receives-10-year- prison-sentence.

"Email Auto-Reply Malware Cryptocurrency Mining." Cointelegraph, 2024, https://cointelegraph.com/news/email-auto-reply-malware-cryptocurrency-mining.

"Is DeFi Ready for Mass Adoption or Will Regulation Slow It Down?" CryptoSlate, 2024, https://cryptoslate.com/is-defi-ready-for-mass-adoption-or-will-regulation-slow-it-down/.

"Hackers Use Generative AI to Write Malware Code." Cointelegraph, 2024, https://cointelegraph.com/news/hackers-use-generative-ai-to-write-malware-code.